Employers are considering the overhead cost savings associated with having a partially remote workforce, as well as the benefits of having appreciative employees who value working from home. Of course, others have indicated that the distractions at home are greater and, thus, they prefer to work in the office.Įmployees are not the only ones to see the benefits of a remote work environment. Some employees are finding the remote work environment to be less distracting, indicating that they are more focused and, thus, more productive when working remotely.

For example, employees with longer commutes are finding they now have more time with their families and more flexibility to tend to personal matters.

#PUNCHING THE CLOCK HOW TO#

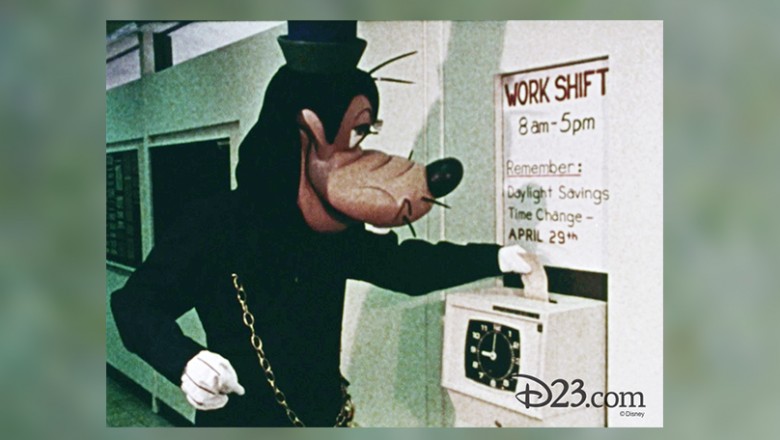

Now, more than a year later, many industries are addressing return-to-work issues, including how to ensure the continued safety of the workforce.Įarly assessment reveals that employees are either (a) preferring a purely remote work environment or (b) looking for a “hybrid” in which they would continue to be permitted to work remotely (at least part of the time). Both employees and employers were challenged by the sudden change in status. Employers scrambled to address technology and logistical concerns associated with making the labor force “work” in a remote environment. In March 2020, millions of workers were forced to work in a remote environment due to the COVID-19 global pandemic. a standard start time, a standard end time, and standard break times. Ensuring accuracy of such records is relatively easy when the supervisor and the employee are both in the same workspace and the employee keeps a regular schedule. However, many industries use more of an honor system in which the employee fills out a weekly timecard and (sometimes) the supervisor also signs off on the timecard. Satisfying wage and hour record-keeping requirements can be relatively straightforward in industries where a traditional punch clock is used. These wage loss lawsuits are difficult to defend, expensive to defend, frequently result in class action litigation, and often come with attorneys’ fees provisions in which the employer must also pay the attorneys’ fees of those attorneys who are successful in their pursuit of these claims on behalf of employees. The challenges to employers who do not maintain adequate time records in defending these wage and hour suits are significant. When the employee is not reporting to the office every day, it is more difficult to track when they are working and when they are not. Managing these time accounting issues is even more difficult when more of the workforce is working remotely. Employees can also claim that they were not provided the required accrual of sick time. For instance, employees can claim they worked hours for which they were not paid. In addition to violating the law, employers who fail to ensure accurate record-keeping can be putting themselves in a position where they are not able to defend against wage and hour claims. The risks to the employer who fails to maintain accurate time records are great.

Importantly, these laws also require the employer to maintain accurate records of employee time worked to comply with these laws.

Of course, it also behooves employers to make sure that they are awarding sick time only for time actually worked. The amount increases to 40 hours of paid sick time for employers with 15 or more workers. Eligible workers are entitled to at least 24 hours of paid sick time if the employer has 14 or fewer workers. In Arizona, under the Fair Wages and Healthy Families Act (“FWHFA”), employees are entitled to accrue sick time at a rate of one hour of paid sick time for every 30 hours that they work. Unless exempt (workers meeting one of the overtime pay exceptions under the FLSA), covered employees must be paid at least the minimum wage and not less than one and one-half times their regular rates of pay for overtime hours worked. The Fair Labor Standards Act (“FLSA”) sets federal minimum wage, overtime pay, recordkeeping, and youth employment standards for employment subject to its provisions. Now that more and more people are looking at working remotely at least part-time, it is time for employers to re-examine how they track time, which they are obligated to do under the law.

0 kommentar(er)

0 kommentar(er)